(continued from Part 1)

The recent military movements and clashes between Iraqi forces and Kurdish Peshmerga in disputed territories renew the risks to Iraq’s economic outlook and business climate, just as the country was benefiting from a string of encouraging economic news. Long-time observers of the country’s economy have been cheered by signs that the Iraqi authorities recognize the need for traditional economic policies that aim for long-term sustainability, and that officials are even exploring possible reforms in areas that external experts have been urging for many years.

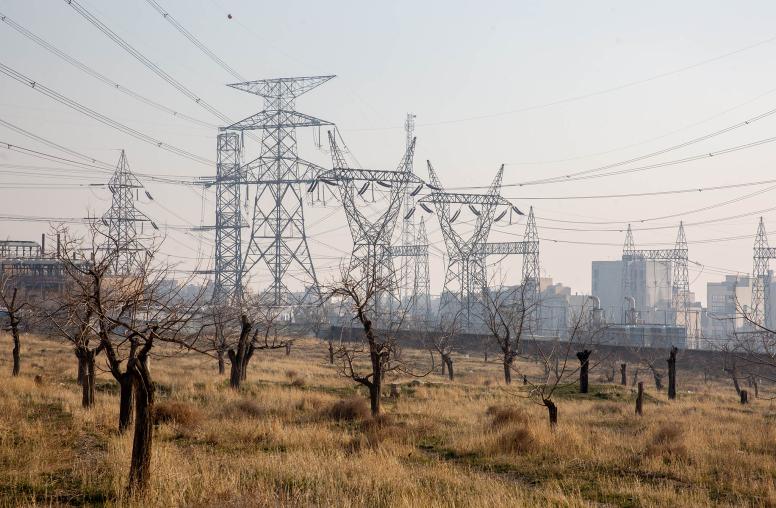

Iraq managed to increase oil production by 1.5 million barrels a day from 2014 to 2016, a 25 percent increase, largely due to earlier oil-sector investments and by completing long-underway infrastructure that supports oil exports.

The increase in volume was critical in helping Iraq weather the steep fall in oil prices in 2014-15. On the strength of that production, Iraq’s GDP grew 11 percent in real terms in 2016, one of the fastest growth rates in the region, according to the International Monetary Fund (IMF). While the non-oil economy shrank and the overall economy is not expected to show robust growth in 2017, the 2016 overall growth rate is nonetheless impressive.

Fallout from Plummet in Oil Prices

The drop in oil prices nevertheless battered Iraq’s fiscal situation, and the central government turned to the IMF for help. To the pleasant surprise of long-time observers of Iraq’s economy, the Iraqi government managed not only to secure IMF board approval of a $5.38 billion standby agreement in December 2016, but has managed to pass two reviews of its program since that time. The second of these reviews required Council of Representatives passage of a supplemental austerity budget, a politically challenging feat.

The commitment of Prime Minister Abadi and his key aides to the IMF program stands in stark contrast to the 2011-13 period, when the Maliki government allowed the IMF program to lapse along with the economic reform agenda and fiscal discipline, thereby setting the stage for the fiscal crisis when oil prices fell in 2014.

The IMF program brought major associated benefits. The World Bank, for example, approved a $1.485 billion loan in return for carrying out certain economic reforms with assistance from the Bank. The IMF seal of approval also facilitated a U.S. government guarantee for a $1 billion Iraqi bond issue. Iraq is one of a very small group of countries for which the U.S. has issued such a guarantee, a powerful signal to financial markets.

Emerging Market Bonds as a Vote of Confidence

Those votes of confidence and the current appetite in financial markets for high-yielding emerging market bonds paved the way for Iraq to successfully issue a $1 billion bond on its own credit in August, its first such bond in over a decade—Iraq was bankrupt at the time of the fall of Saddam Hussein.

Against the backdrop of these promising signs and the ouster of ISIS from most parts of Iraq, authorities need to be careful not to allow the newly-acute tensions to spin into another setback that would just renew the cycle of violent conflict and economic devastation.