Iran Sanctions and the Possible Trade-Offs for a Nuclear Deal

Since 2006, the United States has imposed more sanctions on Iran than any other country, so it may have to cede the most ground to get a nuclear deal in 2014. An expert panel assembled by eight Washington think tanks and organizations examined the potential trade-offs during a discussion July 8 at the U.S. Institute of Peace.

Over the years, Republican and Democratic administrations have issued at least 16 executive orders, and Congress has passed 10 statutes imposing punitive sanctions. What does Tehran want? What are the six major powers considering as incentives—and what isn’t on the table? What will the White House and Congress separately have to do to lift them? The following is a rundown of the panelists’ main points.

Suzanne Maloney

Senior Fellow, The Brookings Institution

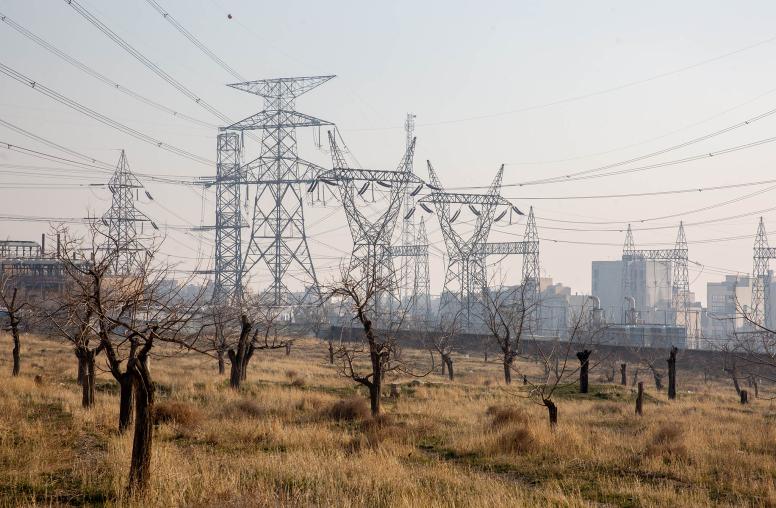

- Sanctions have significantly contracted Iran’s economy and led to product shortages as well as rising inflation and increasing unemployment. Factories have been shut down.

- Financial measures have constricted Iran’s ability to repatriate oil revenues, to sell oil abroad and to access the international financial system generally.

- Sanctions have had an indirect but serious direct impact on ordinary Iranians and on government coffers, shrinking citizens’ incomes and official revenue.

- The unprecedented impact of sanctions during the past four years may have led to some overly ambitious expectations of what such punitive measures can achieve.

- Under sanctions, Iran is forced to conduct much of its trade by bartering, mostly with countries where it holds significant oil revenue because of the difficulty in repatriating revenues. Iran wants access to its funds held in banks worldwide and the ability to use the SWIFT electronic payments system.

- Iran is unlikely to win all the sanctions relief it wants. Relief would be directly linked to concessions on the nuclear issue and fulfillment of commitments.

- While a nuclear deal would lift U.S. sanctions on foreign companies doing business with Iran, it’s not likely to alter the embargo on U.S. business with Iran, which mainly dates from the administration of President Bill Clinton. Sanctions have been applied for many reasons other than the nuclear issue and in many cases predate it.

- So even in the best circumstances, remaining sanctions will apply disproportionately to American businesses over time, while foreign businesses would have more freedom to invest in Iran.

- Iran knows how to get around sanctions, but it does not understand the complex legalities of them as well as the United States.

- The length of a deal is a potential sleeper issue. Iran wants sanctions lifted as soon as possible. But the world’s six major powers —Britain, China, France, Germany, Russia and the United States — want to lift sanctions gradually and extend the time period covered by any deal.

Kenneth Katzman

Specialist in Middle East Affairs, Congressional Research Service

- Separating nuclear-related sanctions from others tied to Iran’s support for terrorism and human rights violations is incredibly difficult. All U.S. sanctions are closely interrelated.

- Iran likely wants all sanctions that were aimed at bringing it to the negotiating table lifted or suspended, basically all sanctions imposed since U.N. Security Council Resolution 1929. Sanctions were ratcheted up dramatically after it was passed in June 2010.

- Iran will almost certainly demand that the ceiling on its oil exports be lifted. Those sanctions, contained in the 2012 National Defense Authorization Act, cut Iran’s exports to 1 million barrels a day from about 2.5 million barrels a day.

- Iran needs financial, oil, gas and shipping sanctions lifted at the same time so that it can sell to foreign countries and repatriate revenues.

- If the two sides come to an agreement, President Obama would likely suspend sanctions using his waiver authority. Almost all of the sanctions laws, due to the constitutional separation of powers, give the president the ability to suspend them. He must certify that suspension is in the national interest, and many of the laws stipulate other certifications.

- One question about suspending sanctions is whether the president can preemptively issue a blanket waiver that would apply in case of future violations. Current law allows a presidential waiver once a violation has occurred.

- A precedent for automatically waiving sanctions does exist. In 1998, European companies Total and Petronas were involved in a project to develop Iran’s South Pars gas field that was determined to be in violation of U.S. sanctions. The European Union threatened to take the United States to the World Trade Organization and file a case. They settled the issue by agreeing that if the European Union cooperates with the United States on opposing Iran’s proliferation activities and support for terrorism, all subsequent similar EU projects would be waived.

- After a year or more of compliance with a deal on Iran’s part, it may ask for permanent relief, which would require Congress to repeal or rewrite sanctions laws.

Elizabeth Rosenberg

Senior Fellow and Director of Energy, Environment and Security Program, Center for a New American Security

- Iran is an attractive business investment opportunity with a well-educated and relatively young population of 80 million. Its large middle class is interested in buying foreign consumer goods. And the country has the world’s fourth-largest proven oil reserves and second-largest natural gas reserves.

- Iran has been courting investors, hosting foreign trade delegations and sending people abroad to discuss new business opportunities. Sanctions relief under a comprehensive nuclear deal could be a game changer for Iran’s economy.

- International businesses, however, would not likely flood Iran the day after a deal for five key reasons:

- Businesses and investors would hesitate unless they are convinced that an agreement will hold and that Iran’s government will enforce it over time.

- The sanctions regime would not immediately evaporate the day after a deal. Nuclear sanctions would be lifted gradually, and penalties for terrorism support, human rights violations and attempts at regional destabilization would stay in place. Also, compliance is complicated for companies because a range of measures apply to various private and government transactions.

- Violating sanctions is expensive and damaging to reputations of international companies. In June, French bank BNP had to pay $9 billion for sanctions violations and agree to cease U.S. dollar clearing activities for a period of time. HSBC had to pay $1.9 billion in 2012.

- Iran presents a challenging business environment. Corruption is widespread. The government would need to make changes to its investment and regulatory regimes to be hospitable to international investors. Relationships would take time to rebuild.

- Congress could undermine a potential deal by either rejecting the agreement or by imposing new sanctions.. Tehran would likely interpret any new sanctions as ill will aimed at sabotaging a deal..

- The private sector would prefer a coordinated lifting of sanctions by the international community. For example, a company that conducts business in both Europe and the United States could risk losing its U.S. business by investing in Iran based on an easing of EU sanctions before the United States.

- The so-called P5+1 powers should be careful not to overpromise on sanctions relief. Underperformance by the private sector could create a credibility problem for the P5+1 if Iran doesn’t feel the other side is fulfilling its obligations.

Robin Wright (Moderator and discussant)

Joint Fellow, U.S. Institute of Peace and the Woodrow Wilson Center for International Scholars

- Sanctions have not had the same impact that they did during the 1980-1988 Iran-Iraq War, when the government was faced with huge shortages of gasoline, meat and other basic commodities.

- Enormous wealth still exists in some sectors. Porsche dealers in Tehran are selling 911 S Carreras for $300,000, and they cannot keep them in stock.

- At the same time, Ahmadinejad did major damage to the economy— even though more than half of Iran’s oil revenues since the discovery of oil were earned under his presidency.

- Mismanagement may have been just as important a factor as sanctions in ruining the economy.

- The Islamic State in Iraq and Syria (recently renamed Islamic State) may be a dark horse factor in negotiations. A circle of Salafi or Wahhabi militant organizations, including the Taliban, now surrounds Iran. Ironically, Tehran feels less secure after U.S. withdrawals from Afghanistan and Iraq.

To assess this period of pivotal diplomacy, an unprecedented coalition of eight Washington think tanks and organizations is hosting discussions to coincide with the last rounds of talks.

The first event focused on the disparate issues to be resolved and the many formulations for potential solutions.

The second event examined U.S.-Iran tensions over timetables and terms.

The coalition includes the U.S. Institute of Peace, RAND, the Woodrow Wilson International Center for Scholars, the Arms Control Association, the Center for a New American Security, the Stimson Center, the Partnership for a Secure America, and the Ploughshares Fund.

Garrett Nada is a senior program assistant for Iran and Middle East programs at USIP. For more news, analysis and information on Iran, see USIP’s Iran Primer web site, produced in partnership with the Woodrow Wilson Center.