How Will China’s Bid to Join a Trans-Pacific Trade Pact Affect Regional Stability?

Beijing’s application is a reminder that competition with China in the Asia-Pacific is occurring on multiple fronts.

On September 16, China applied to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). The trade bloc, which includes 11 Asia-Pacific economies — Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam — is based on the Trans-Pacific Partnership (TPP). The TPP was initially championed by Washington to deepen economic integration between the United States and the Asia-Pacific, but the Trump administration withdrew from the TPP in early 2017, prompting its 11 remaining members to negotiate the new CPTPP.

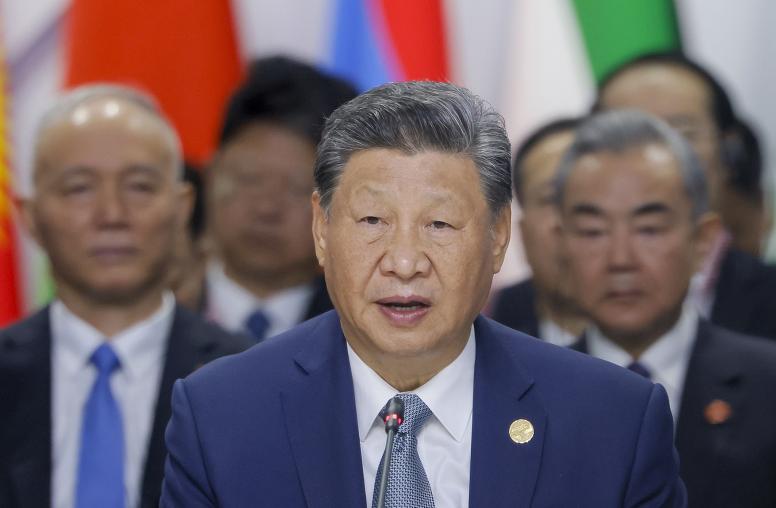

General Secretary of China’s Communist Party, Xi Jinping, had previously indicated China’s potential interest in joining the CPTPP, so Beijing’s application is no surprise. USIP’s Carla Freeman says China’s membership in the CPTPP will only increase Beijing’s relative regional influence and prompt more calls for the Biden administration to also join the pact.

Why is China interested in joining an agreement that was once seen by the United States as important to countering China in Asia?

The Obama administration had promoted the TPP as a central pillar of its “Rebalance to Asia” plan to revitalize “the open rules-based economic system” across the Pacific. However, the United States did not rule out the possibility that the bloc could eventually include China — if Beijing was willing to meet the TPP’s stringent standards for trade liberalization and transparency. The CPTPP retains most TPP provisions, with the principal exception being the removal of a set of terms on intellectual property.

Even as China lobbied across the region for support for the less rigorous Regional Comprehensive Economic Partnership (RCEP) trade deal concluded last year, it described the TPP as “one of the key free trade agreements” and indicated it could be open to joining.

Given the considerable seven-country overlap between RCEP and CPTPP membership, China may calculate that it has influence that it can use to join the CPTPP club, which could add hundreds of billions of dollars to its national income within a decade.

In addition to the prospect of income gains from joining CPTPP, membership in the bloc serves China’s interests on several other fronts. For one, it would add an additional arrow, along with RCEP, to China’s quiver against economic losses from its trade war with the United States by expanding its network of trade partners and adding resilience to supply chains.

There may also be a domestic policy logic underlying Beijing’s interest in CPTPP accession. Just as China used accession to the World Trade Organization to spur changes to its domestic economic system, pursuing CPTPP with its high standards for a range of sectors may offer a shot in the arm for an economy facing slowing growth by making it subject to commitments that improve its perceived investment climate. Its application could also seek to counter growing evidence that China is pivoting away from economic liberalization at home.

Is China’s membership in CPTPP a given?

To win membership in CPTPP, China needs support from all members of the bloc who have ratified the agreement (currently eight members, with the exception of Brunei, Chile and Malaysia). They must be convinced China will meet the agreement’s provisions by showing it can undertake politically challenging economic reforms. These range from boosting the transparency of state-owned enterprises (SOEs) and meeting the agreement’s terms on subsidies and assistance like low-cost loans to SOEs to implementing changes to existing restrictions on data flows and new standards for labor. Other provisions would require China to take steps to strengthen intellectual property protections as well as eliminate the requirement that most foreign investors have a local partner, thus ending some of the practices associated with China’s “Made in China 2025” plan to promote indigenous production.

Given China’s enormous economic weight in the regional economy, there are worries that China could try to pressure CPTPP member countries to relax the terms for its admission. Vietnam was granted a number of exceptions for its state sector. However, CPTPP members like Japan, which are struggling with the distorting effects of Chinese subsidies on international trade, are unlikely to endorse similar exceptions for China. There is also skepticism about China’s adherence to the letter of the agreement based on what many observers see as its mixed record on compliance.

Are there geostrategic motives for China’s CPTPP bid?

Debates among CPTPP members and the difficulties of undertaking economic reforms that would satisfy CPTPP provisions are likely to stymie Beijing’s entry into the agreement. Nevertheless, in the immediate term, Beijing’s CPTPP application is a shrewd diplomatic and strategic maneuver on the Indo-Pacific chessboard. Beijing formally pursued admission via anti-nuclear New Zealand as depository within a day of the announcement of the AUKUS pact among Australia, the United Kingdom and the United States that will transfer U.S. nuclear submarine to technology to Canberra. Chinese officials had attacked the tripartite security arrangement and contrasted what Foreign Ministry spokesman Zhao Lijian decried as its promotion of “war and destruction” with China’s pursuit of regional integration.

There is also a cross-Strait dimension to the timing of China’s application. Earlier discussions between Tokyo and Taipei on Taiwan’s membership drew opprobrium from Beijing, no doubt concerned that Taiwan would beat it to the gate in applying to join the bloc. Ultimately, Taipei’s application to the trade agreement followed Beijing’s by less than a week. Beijing immediately called upon CPTPP members to reject Taiwan’s bid for membership, as it has all of Taiwan’s efforts to join international organizations. Several CPTPP members, notably Australia, Canada and Japan, appear to welcome Taiwan’s membership. However, China’s record of using economic pressure against countries that it sees acting against its preferences may limit support from CPTPP members unwilling to put their own bilateral economic relations with China in jeopardy. Others see value for their own economies in prioritizing China’s entry over Taiwan’s.

What are the implications for the CPTPP of China’s accession?

Beijing and Taipei’s dueling bids for membership in the trade agreement foreshadow future political challenges for the CPTPP should China win membership. China could oppose expanding membership to include other partners with close U.S. ties, complicating CPTPP enlargement. The United Kingdom, which formally applied for CPTPP membership in 2020, has begun negotiations on accession. Some worry that China will exploit anxiety in some regional capitals that Britain’s membership will weaken the CPTPP as a vehicle for free trade in the region to lobby against adding another close U.S. ally to the trade pact.

Immediately, opposition to or foot-dragging on China’s entry from some CPTPP members could also become a source of tension both within the pact and across the region. Australia has made clear that negotiations on China’s application for the CPTPP are off the table until China removes its retaliatory informal bans and anti-dumping duties on Australian products. Speculation that the United States could invoke Article 32:10 of the U.S.-Mexico-Canada Agreement (USMCA), which requires consultations among members, to force Canada and Mexico not to negotiate on a free trade agreement with a non-market economy (China) suggests how China’s CPTPP membership bid alone could become a source of stress in the United States’ relations with its immediate neighbors.

What does China’s application to join CPTPP mean for the United States and the prospects of it rejoining the pact?

The Biden administration has indicated that it will not pursue CPTPP membership. However, Beijing’s CPTPP bid has put a spotlight Washington’s absence in regional trade agreements, including RCEP as well as CPTPP, that are increasingly deepening economic integration in the Asia-Pacific.

Even if Beijing’s accession to enter the CPTPP takes time, if it happens there would be significant downsides for the United States. For one, as a Peterson Institute for International Economics study points out, membership in the CPTPP will likely shift exports and imports of other countries in the bloc toward China — which would only build China’s economic muscle. Once in the pact, Beijing could shape the agreement, blocking Taiwan’s application and preventing U.S. entry should Washington reconsider its interest in the pact. In short, membership in the CPTPP will only increase China’s relative regional influence. As a result, some have begun urging the Biden administration to reconsider its position on CPTPP membership for the United States.

Are there risks to regional stability from China’s CPTPP application?

In the immediate term, if Beijing’s CPTPP bid is seen mainly as a tactic to strengthen China’s image as a champion of regional economic integration and trade policy, it is unlikely to have gained China much ground. Given ongoing regional tensions over maritime disputes and pressure from China’s warplanes on Taiwan, countries across the region remain wary of China’s intentions and welcome the commitment the United States has made to regional defense. However, China’s CPTPP maneuver is a reminder that competition with China in the Asia-Pacific is occurring on multiple fronts, requiring deft statecraft that draws on the full array of U.S. capabilities.